Outstanding Present Value Of Future Cash Flows Excel Template

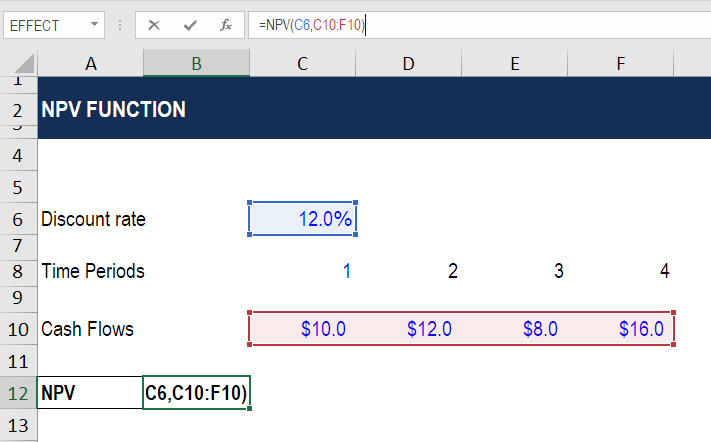

NPV returns the net value of the cash flows represented in todays dollars.

Present value of future cash flows excel template. This function is useful to find the dollar present value for both multiple periodic cash flows and also single lump-sum payments. PV in excel function is commonly used to compare investment alternatives as in stock valuation bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity. Net Present Value Calculator template is a tool to identify the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Then you would have to establish the cash balance of the present year. Follow us on twitter. To better understand the idea lets dig a little deeper.

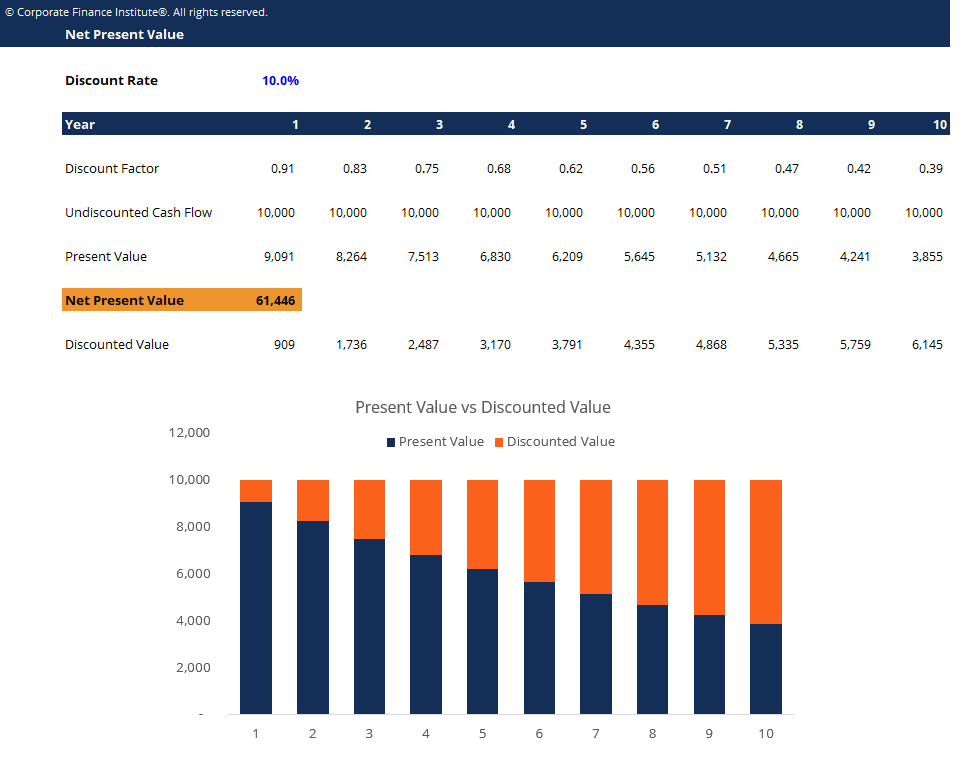

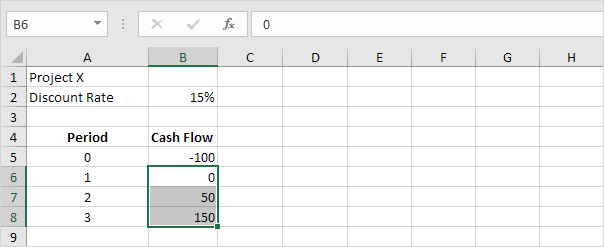

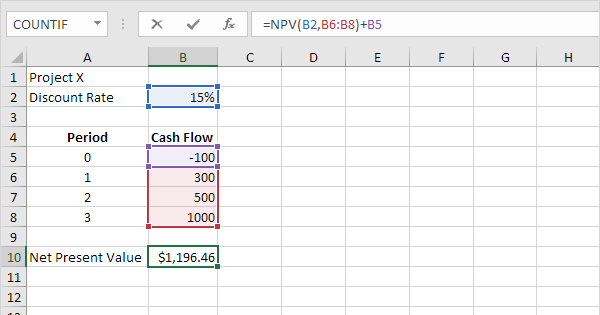

In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. It gathers the data of the estimated cash flows in the future by dividing them into discount rates to find the Present Value of each cash flow. NPV in Excel is a bit tricky because of how the function is implemented.

This is also known as the present value pv of a future cash flow. NPV PV of future cash flows Initial Investment. The amount you will need to invest can be calculated by typing the following formula into any Excel cell.

Use this simple easy-to-complete DCF template for valuing a company a project or an asset based on future cash flowEnter year-by-year income details cash inflow fixed and variable expenses cash outflow net cash and discounted cash flow present value and cumulative present value to arrive at the net present value of. For example if you want a future value of 15000 in 5 years time from an investment which earns an annual interest rate of 4 the present value of this investment ie. Free cash flow analysis templates will help you get a better idea of how to make the most of the templates that are available online.

The formula for NPV is. PV is an Excel financial function that returns the present value of an annuity loan or investment based on a constant interest rate. The discount rate is the rate for one period assumed to be annual.