Amazing Npv Excel Template

This article describes the formula syntax and usage of the NPV function in Microsoft Excel.

Npv excel template. Ad High-Quality Fill-in The Blanks Templates Created By Business Experts Lawyers. This is important because it factors in the time value of money and the associated interest and opportunity costs. NPV analysis is a form of intrinsic valuation and is used extensively across.

Net Present Value Formula Example 2. Its quite straightforward and makes the calculation of NPV really simple. It gathers the data of the estimated cash flows in the future by dividing them into discount rates to find the Present Value of each.

For example we have 10 payments made at the discount rate of 5. For example project X requires an initial investment of 100 cell B5. Ad High-Quality Fill-in The Blanks Templates Created By Business Experts Lawyers.

It also displays comparative charts of actual vs expected return as well as return rates. This template helps you to compare two scenarios of investment having different discount rates. It also helps to compare with different investment options and to easily decide whether to introduce the new product.

Project B requires an investment of 750000 which will give a return of 100000 150000 200000 250000 and 250000 for the next 5 years. NPV and XIRR calculator is a ready-to-use excel template that helps you to calculate Net Present Value and Rate of Return for a given investment. Net Present Value XNPV rate values dates.

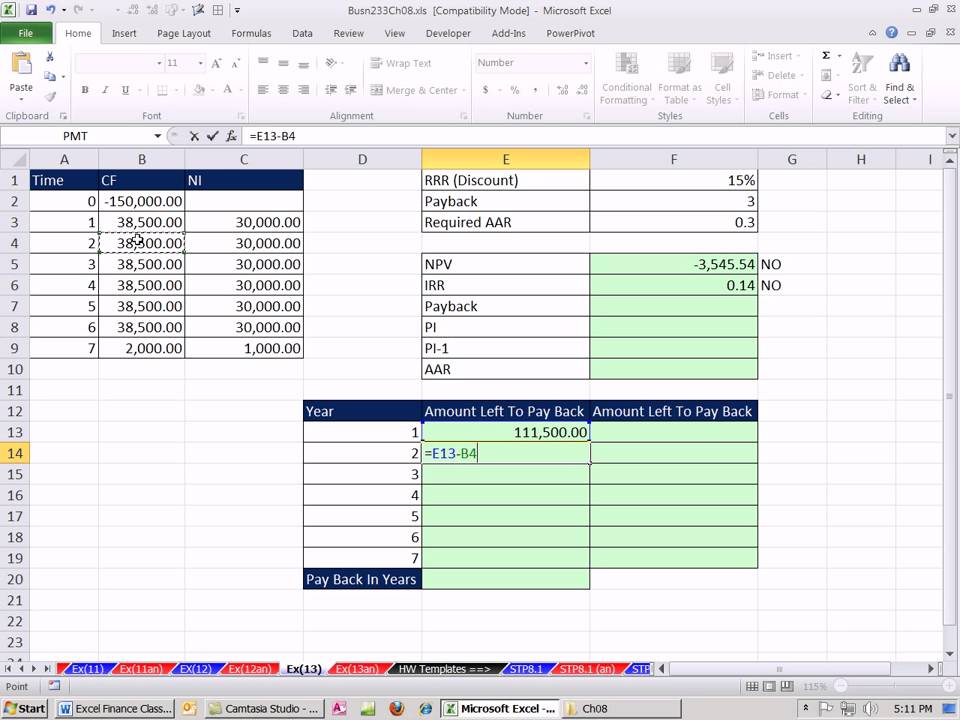

Savvy investors and company management will use some. Such as png jpg animated gifs pic art logo black and white transparent etc. Excel HW 4 - templatexlsxPreview the document Assumptions Tab Insert placeholder data of your choosing into yellow input cells Create dynamic calculations for all non-input cells Worksheet tab Create dynamic calculations using data from assumptions tab ROI Tab Create dynamic cash flow calculations for each year using data from the other tabs Use excel formulas to calculate NPV and IRR.