Marvelous Accountable Reimbursement Plan Template

What Makes A Reimbursement Plan Accountable.

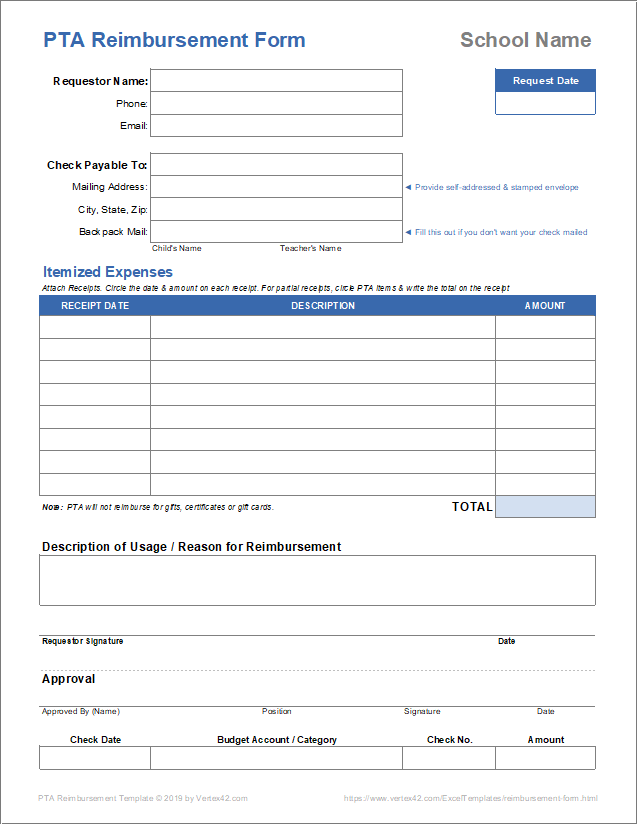

Accountable reimbursement plan template. If set up correctly reimbursed business expenses do not have to be treated as taxable income. But after completing the Accountable Plan Worksheet and Reimbursement form the company owed you 5000. Accountable Reimbursement Plan ARP Non-Accountable Plan.

Divide the square footage used for business by the. Reimbursement requests for the business use of your personal things and direct expenses. The confusing thing about accountable plans is that you dont need to file any forms or get any kind of permission from the IRS.

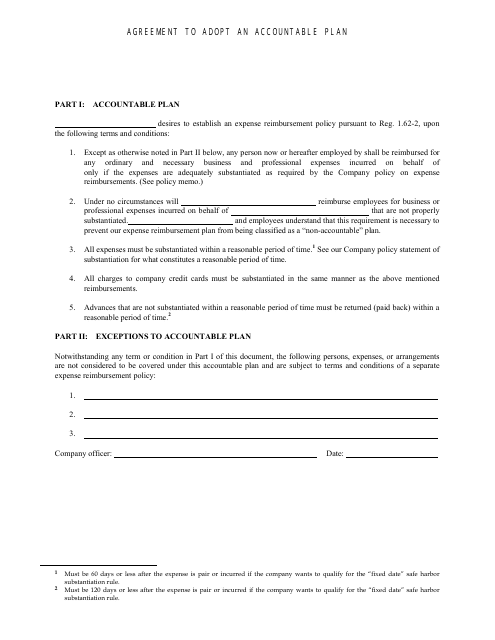

162-2 upon the following terms and conditions. Calculate the percentage of your home that is used exclusively for business purposes. The benefits of having an accountable reimbursement plan are many but it is most important to reinforce it by its terms.

Draft an accountable plan agreement for your company. Last week we discussed the value of an accountable reimbursement plan for churches now that pastors can no longer deduct their unreimbursed business expenses. ACCOUNTABLE REIMBURSEMENT POLICY The following are suggested items for inclusion in this accountable reimbursement policy.

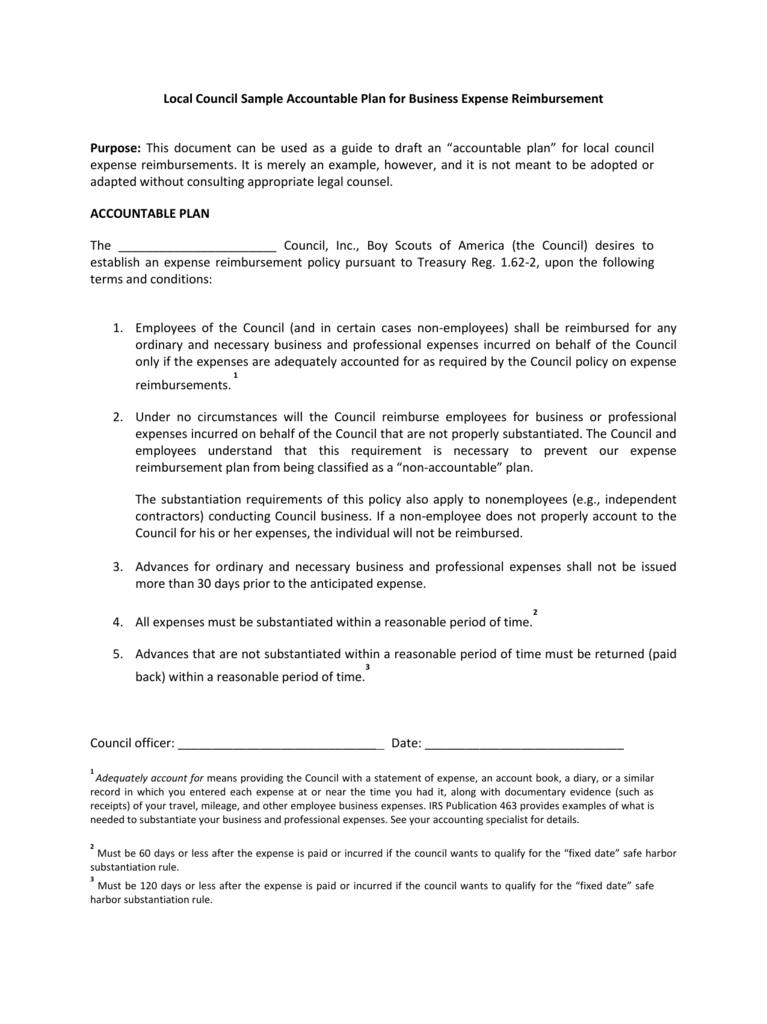

Desires to establish an expense reimbursement policy pursuant to Treas. An accountable reimbursement plan is an employee reimbursement arrangement or method for reimbursing employees for legitimate business expenses. The committee or staff overseeing the plan has the right to determine if a receipt presented for reimbursement is an acceptable church related business expense for reimbursement.

This document can be used as a guide to draft an accountable plan for expense reimbursements However it is merely an example and it is not meant to be adopted or adapted without consulting appropriate legal counsel. The church should not report any expenses reimbursed properly under an accountable reimbursement plan as taxable income on the employees W-2. Payments under such a plan are.